Sponsored

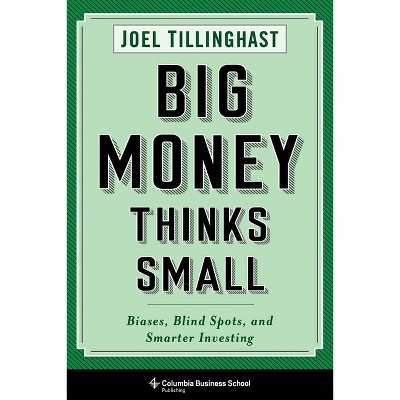

Big Money Thinks Small - (Columbia Business School Publishing) by Joel Tillinghast (Paperback)

$13.10Save $5.85 (31% off)

In Stock

Eligible for registries and wish lists

Sponsored

About this item

Highlights

- Investors are tempted daily by misleading or incomplete information.

- About the Author: Joel Tillinghast is a Chartered Financial Analyst (CFA) charterholder and thirty-six-year veteran of the investments industry.

- 312 Pages

- Business + Money Management, Personal Finance

- Series Name: Columbia Business School Publishing

Description

About the Book

In Big Money Thinks Small, veteran fund manager Joel Tillinghast offers a set of simple but crucial steps to successful investing. Tillinghast teaches readers how to learn from their mistakes--and his own, giving investors the tools to ask the right questions in any situation and to think objectively and generatively about portfolio management.Book Synopsis

Investors are tempted daily by misleading or incomplete information. They may make a lucky bet, realize a sizable profit, and find themselves full of confidence. Their next high-stakes gamble might backfire, not only hitting them in the balance sheet but also taking a mental and emotional toll. Even veteran investors can be caught off guard: a news item may suddenly cause havoc for an industry they've invested in; crowd mentality among fellow investors may skew the market; a CEO may turn out to be unprepared to effectively guide a company. How can one stay focused in such a volatile profession? If you can't trust your past successes to plan and predict, how can you avoid risky situations in the future? In Big Money Thinks Small, veteran fund manager Joel Tillinghast shows investors how to avoid making these mistakes. He offers a set of simple but crucial steps to successful investing, including:- Know yourself, how you arrive at decisions, and how you might be susceptible to self-deception.

- Make decisions based on your own expertise, and do not invest in what you don't understand.

- Select only trustworthy and capable colleagues and collaborators.

- Learn how to identify and avoid investments with inherent flaws.

- Always search for bargains, and never forget that the first responsibility of an investor is to identify mispriced stocks. Patience and methodical planning will pay far greater dividends than flashy investments. Tillinghast teaches readers how to learn from their mistakes--and his own, giving investors the tools to ask the right questions in any situation and to think objectively and generatively about portfolio management.

Review Quotes

[This book] is an intelligent guide to stock selection and investment that deserves a place on everyone's bookshelf, whether they work in the City or just want to find some shares to put into their Isa.-- "MoneyWeek"

Named one of the five best books of 2017-- "Money Week"

Tillinghast's book is a cornucopia of investing wisdom, some acquired as a result of the inevitable mistakes, which he readily shares.-- "Investing.com"

What could look like anecdotes and unrelated points come together to form a valuable approach to investing...it's a collection of investment wisdom. I'll certainly re-read many passages of this book over and over again. Highly recommended for seasoned investors.-- "Strictly Value"

Written for investors at all levels, this practical, no-nonsense guide . . . empower[s] readers to generate their own informed decisions.-- "Publishers Weekly"

For decades I have admired and learned from Joel Tillinghast's extraordinary investment prowess. Whether you are a professional or an individual investor, you will be a better investor after reading and absorbing the wisdom in this book.--Bill Miller, founder and CIO, Miller Value Partners

Tillinghast has built an outstanding investment record over three decades by being smart and disciplined. Now, all of us can benefit from his hard-won wisdom and perceptive insights, which are found on literally every page of this fine book.--Seth A. Klarman, Portfolio Manager and CEO, The Baupost Group, LLC

Tillinghast provides a very useful checklist of the required due diligence of investments, the tenets of value investing, the need to more carefully understand the culture and rule of law of foreign countries before investing in them, and how to stay within your circle of competence.--David Kass, University of Maryland

About the Author

Joel Tillinghast is a Chartered Financial Analyst (CFA) charterholder and thirty-six-year veteran of the investments industry. He has been the manager of the Fidelity(R) Low-Priced Stock Fund since 1989.Dimensions (Overall): 8.7 Inches (H) x 5.6 Inches (W) x .8 Inches (D)

Weight: .85 Pounds

Suggested Age: 22 Years and Up

Number of Pages: 312

Genre: Business + Money Management

Sub-Genre: Personal Finance

Series Title: Columbia Business School Publishing

Publisher: Columbia Business School Publishing

Theme: Investing

Format: Paperback

Author: Joel Tillinghast

Language: English

Street Date: February 18, 2020

TCIN: 82969526

UPC: 9780231175715

Item Number (DPCI): 247-19-9350

Origin: Made in the USA or Imported

If the item details aren’t accurate or complete, we want to know about it.

Shipping details

Estimated ship dimensions: 0.8 inches length x 5.6 inches width x 8.7 inches height

Estimated ship weight: 0.85 pounds

We regret that this item cannot be shipped to PO Boxes.

This item cannot be shipped to the following locations: American Samoa (see also separate entry under AS), Guam (see also separate entry under GU), Northern Mariana Islands, Puerto Rico (see also separate entry under PR), United States Minor Outlying Islands, Virgin Islands, U.S., APO/FPO

Return details

This item can be returned to any Target store or Target.com.

This item must be returned within 90 days of the date it was purchased in store, shipped, delivered by a Shipt shopper, or made ready for pickup.

See the return policy for complete information.

Frequently bought together

$15.68

Buy 2, get 1 free select books, music & movies

4.8 out of 5 stars with 192 ratings

$14.39

MSRP $19.00

Buy 2, get 1 free select books, music & movies

4.6 out of 5 stars with 144 ratings

Guests also viewed

$26.93

MSRP $30.00

Buy 2, get 1 free select books, music & movies

5 out of 5 stars with 1 ratings