Sponsored

Structuring Sustainable Finance Transactions - by Aaron Franklin (Hardcover)

In Stock

Sponsored

About this item

Highlights

- The rapid rise of green bonds, sustainability-linked loans and other sustainable finance transactions has been one of the most surprising developments in corporate finance over the past 15 years.

- About the Author: Aaron Franklin is one of the world's most experienced practitioners in structuring and executing sustainable finance transactions.

- 250 Pages

- Business + Money Management, Finance

Description

Book Synopsis

The rapid rise of green bonds, sustainability-linked loans and other sustainable finance transactions has been one of the most surprising developments in corporate finance over the past 15 years. Sustainable finance is rapidly growing as an educational subject among top universities, business schools and law schools, separate from the only somewhat related "ESG" and sustainable investing trends. But sustainable finance transactions are prone to being misunderstood, sometimes the subject of controversy and structured largely behind closed doors. Mainstream news outlets, NGOs and political leaders routinely criticize this evolving market, with arguments ranging from greenwashing (not doing enough) to anti-ESG (doing too much). Making matters worse, there is a dearth of pragmatic, comprehensive and objective resources to help students and practitioners go beyond a superficial understanding.This book will be a first-of-its-kind resource unlocking the mysteries of structuring and executing sustainable finance transactions. This book addresses the entire spectrum of new and emerging transaction types, as well as the rarely articulated concepts explaining why these deals work the way they do.

From the Back Cover

The rapid rise of green bonds, sustainability-linked loans and other sustainable finance transactions has been one of the most surprising developments in corporate finance over the past 15 years. Sustainable finance is rapidly growing as an educational subject among top universities, business schools and law schools, separate from the only somewhat related "ESG" and sustainable investing trends.

But sustainable finance transactions are prone to being misunderstood, sometimes the subject of controversy and structured largely behind closed doors. Mainstream news outlets, NGOs and political leaders routinely criticize this evolving market, with arguments ranging from greenwashing (not doing enough) to anti-ESG (doing too much). Making matters worse, there is a dearth of pragmatic, comprehensive and objective resources to help students and practitioners go beyond a superficial understanding.

This book will be a first-of-its-kind resource unlocking the mysteries of structuring and executing sustainable finance transactions. This book addresses the entire spectrum of new and emerging transaction types, as well as the rarely articulated concepts explaining why these deals work the way they do.

Aaron Franklin is one of the world's most experienced practitioners in structuring and executing sustainable finance transactions. He has a decade of experience across two continents, working as an attorney, banker and underwriter on many pioneering transactions. Aaron's work in sustainable finance began in 2014 with advising clients on the legal issues raised by green bonds as an attorney working in the London office of one of the world's largest law firms (Latham & Watkins). He went on to be named the firm's Global Coordinator for Sustainable Capital Markets in 2017 and later founded the firm's global Sustainable Finance practice. Aaron participated in sustainable finance transactions across the world in this role, including advising the underwriters on the first ever sustainability-linked bond. After relocating his practice to New York, in 2020 Aaron shifted his focus from the law to the business of sustainable finance by launching the sustainable finance platform at one of the world's largest banks. In nearly five years at this role, Aaron led sustainable finance structuring for hundreds of green bonds, green loans, sustainability-linked loans and other financial transactions across North and South America and across a wide variety of industries.

About the Author

Aaron Franklin is one of the world's most experienced practitioners in structuring and executing sustainable finance transactions. He has a decade of experience across two continents, working as an attorney, banker and underwriter on many pioneering transactions. Aaron's work in sustainable finance began in 2014 with advising clients on the legal issues raised by green bonds as an attorney working in the London office of one of the world's largest law firms (Latham & Watkins). He went on to be named the firm's Global Coordinator for Sustainable Capital Markets in 2017 and later founded the firm's global Sustainable Finance practice. Aaron participated in sustainable finance transactions across the world in this role, including advising the underwriters on the first ever sustainability-linked bond. After relocating his practice to New York, in 2020 Aaron shifted his focus from the law to the business of sustainable finance by launching the sustainable finance platform at one of the world's largest banks. In nearly five years at this role, Aaron led sustainable finance structuring for hundreds of green bonds, green loans, sustainability-linked loans and other financial transactions across North and South America and across a wide variety of industries.Shipping details

Return details

Frequently bought together

Trending Non-Fiction

Discover more options

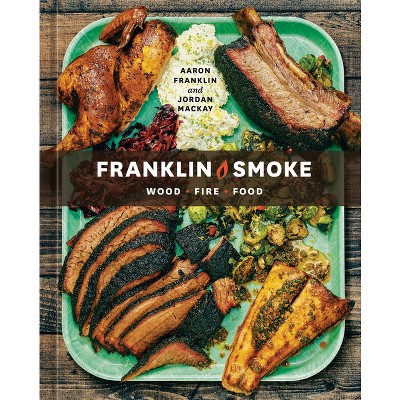

![The Franklin Barbecue Collection [Special Edition, Two-Book Boxed Set] - by Aaron Franklin & Jordan MacKay (Mixed Media Product)](https://target.scene7.com/is/image/Target/GUEST_cada50ef-b9aa-4785-9279-d06ffc908a99)